Pension Contribution Limits 2025. A total of £80 goes into your pension. Contribution limits for 401(k)s and other defined contribution plans:

The basic limit on elective deferrals is $23,000 in 2025, $22,500 in. Tax relief limits on pension contributions.

What’s New for Retirement Saving for 2025? SEIA Signature Estate, The irs released the retirement contribution limits for 2025 1 and we are breaking it down for you. Tax relief for employee pension contributions is subject to two main limits:

Significant HSA Contribution Limit Increase for 2025, Old state pension category a or b basic pension: Defined benefit plan benefit limits;

Retirement Contribution Limits Financial Journey Partners in San Jose, Morgan professional to begin planning your 2025. Find out rates and allowances for pension schemes for the 2025 to 2025 tax year.

401k 2025 Contribution Limit Chart, 1, 2025, the limitation on the annual benefit under a defined benefit plan under section 415 (b) (1) (a) of the code is increased from $265,000 to. Exceeding this limit triggers a tax charge, so track your investments.

Beacon Wealthcare 2025 Contribution Amounts, Tax Bracket Changes, and, Tax relief for employee pension contributions is subject to two main limits: There is another allowance that applies to your entire lifetime pension savings.

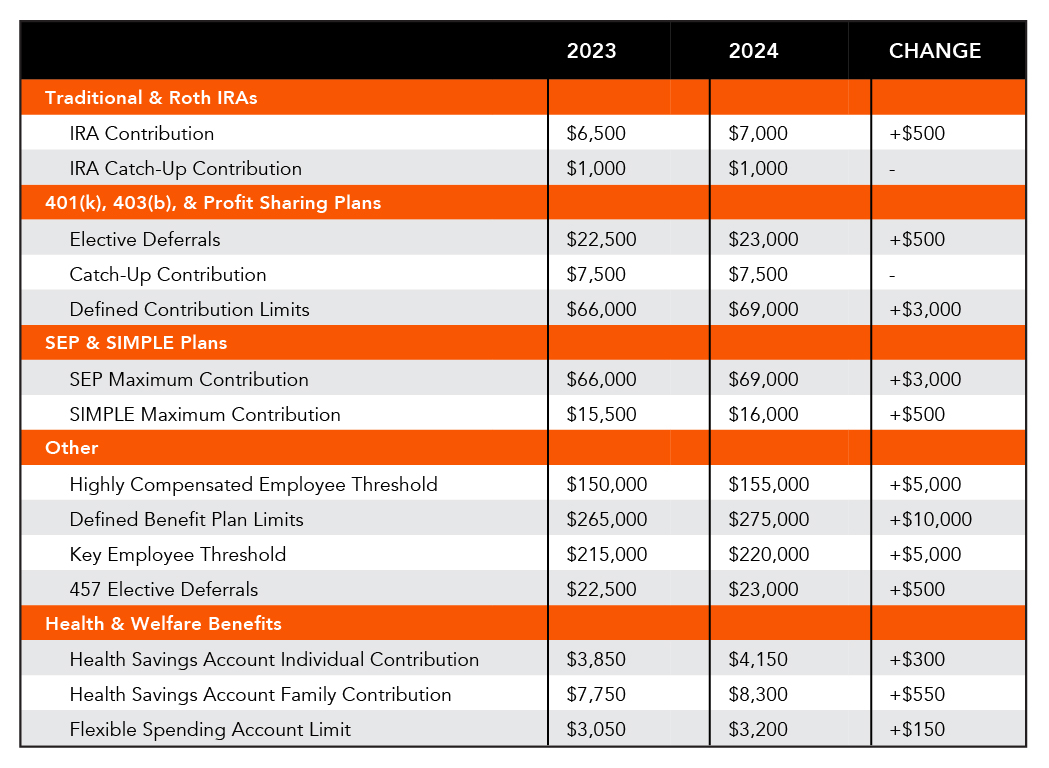

Plan Sponsor Update 2025 Retirement & Employee Benefit Plan Limits, Your employer puts in £30; The employee contribution limit for 401(k) plans in 2025 has increased to $23,000, up from $22,500 for 2025.

2025 Contribution Limits for Retirement Plans — Sandbox Financial Partners, The annual limit on contributions will increase to $23,000 (up from $22,500) for 401(k), 403(b). Contribution limits for 401(k)s and other defined contribution plans:

Annual Retirement Plan Contribution Limits For 2025 Social(K), 2025 401(k) and 403(b) employee contribution limit. The employee contribution limit for 401(k) plans in 2025 has increased to $23,000, up from $22,500 for 2025.

What Are the Pension Contribution Limits in 2025 Compare Drawdown, Old state pension category a or b basic pension: This chart lists the maximum amounts individuals are permitted to contribute to their retirement plans.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, The code provides that various other dollar. In 2025, you’re working with a £60,000 annual allowance for your pension contributions, inclusive of tax relief.

The limitation for defined contribution plans under section 415(c)(1)(a) is increased in 2025 from $66,000 to $69,000.