Tax Brackets 2025 South Africa Sars. Do you need to register for income tax? You are viewing the income tax rates, thresholds and allowances for the 2025 tax year in south africa.

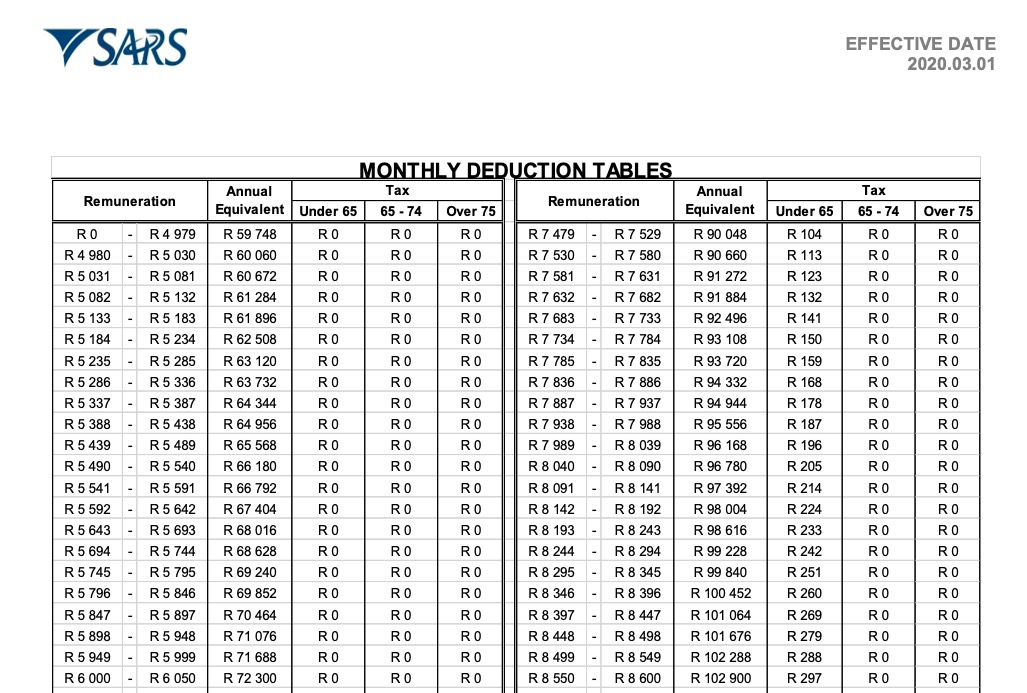

If you are 65 to below 75 years old, the tax threshold (i.e. The south african revenue service (sars) provides tax tables annually to help individuals and businesses calculate their tax liabilities.

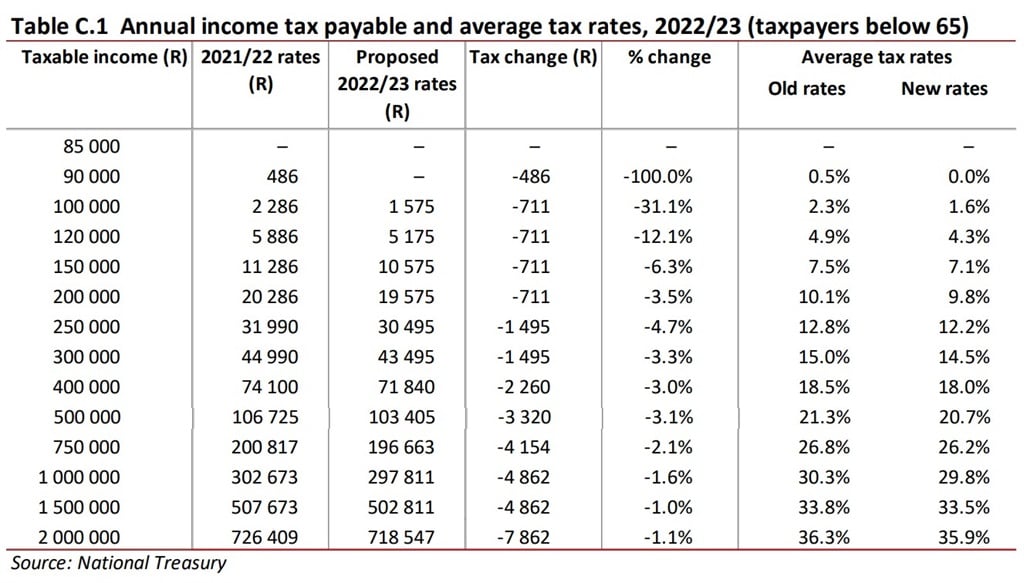

Tax Brackets South Africa 2025 Megan Macleod, Tax rates are proposed by the minister of finance in the annual budget speech and fixed or passed by parliament each year.

Tax Brackets South Africa 2025 Megan Macleod, The 2025 tax year is from march 1, 2025, to february 28, 2025.

SARS is not slowing down despite red flags over South Africa’s, If your income exceeds the tax thresholds, then you will need to register as a tax payer with sars.

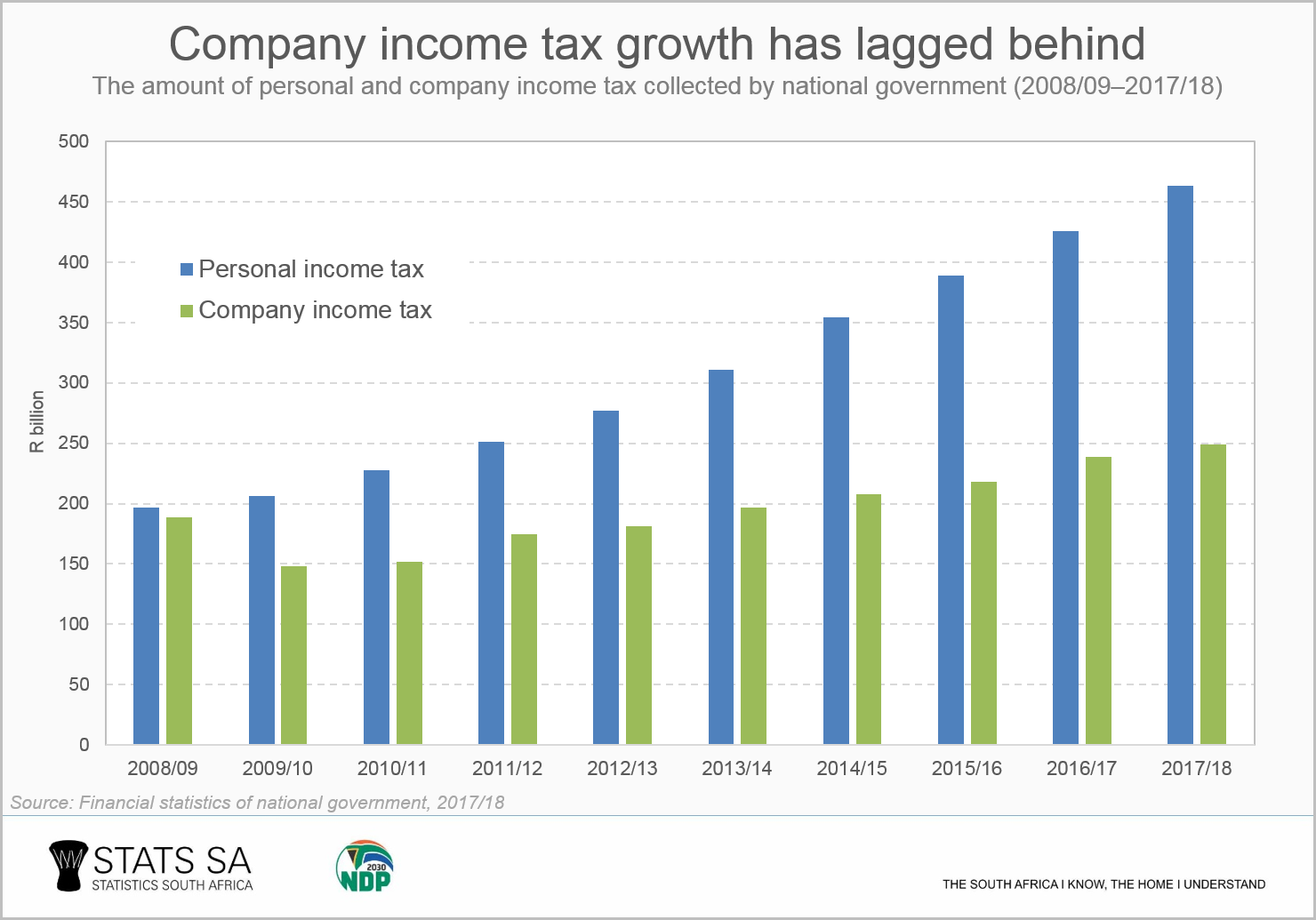

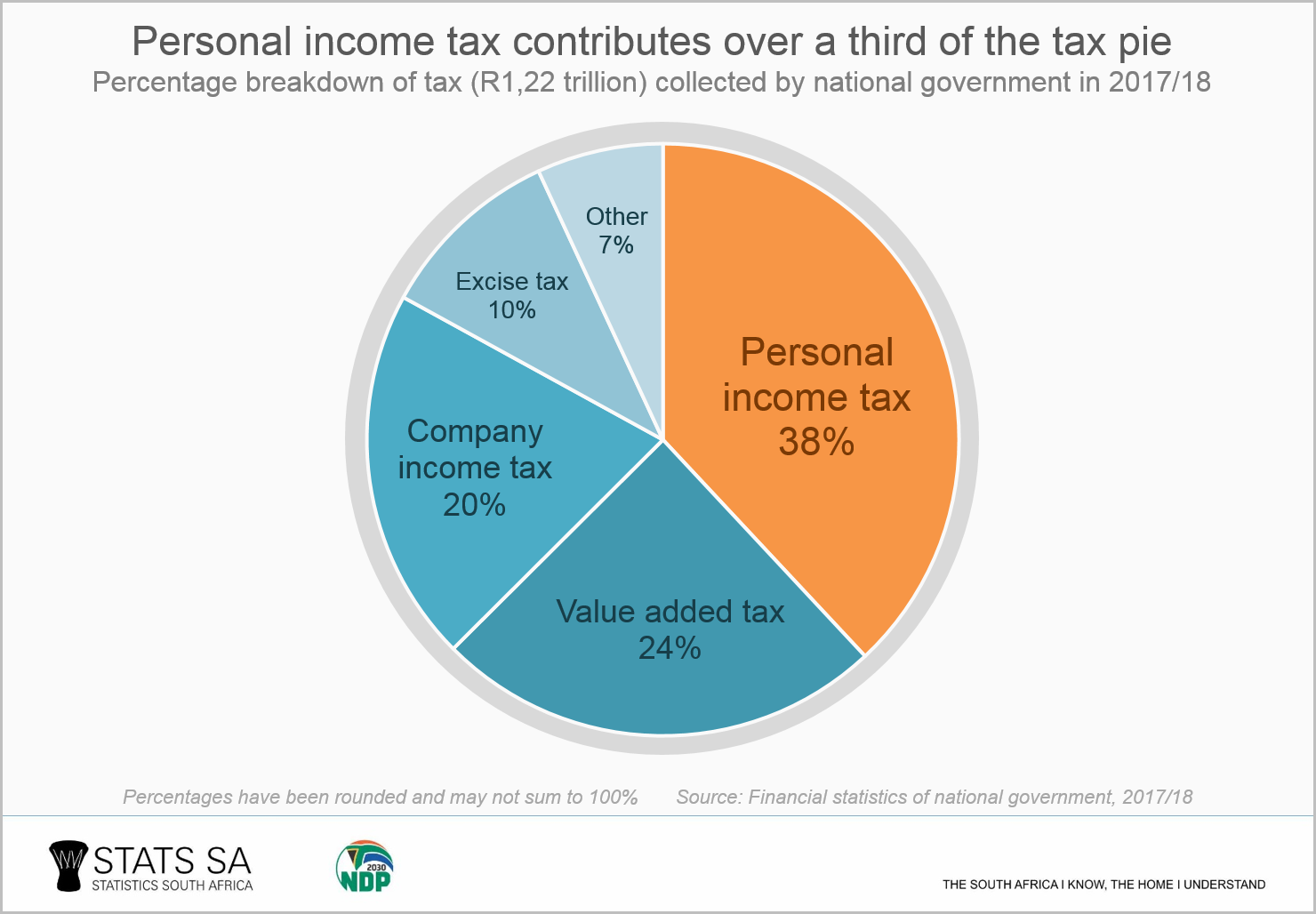

Tax Brackets 2025 South Africa Ella Rampling, The latest tax data from sars shows that the taxman collected r2.2 trillion in gross tax revenue in the 2025/24 fiscal year, r87.0 billion or 4.2% more than in the prior year.

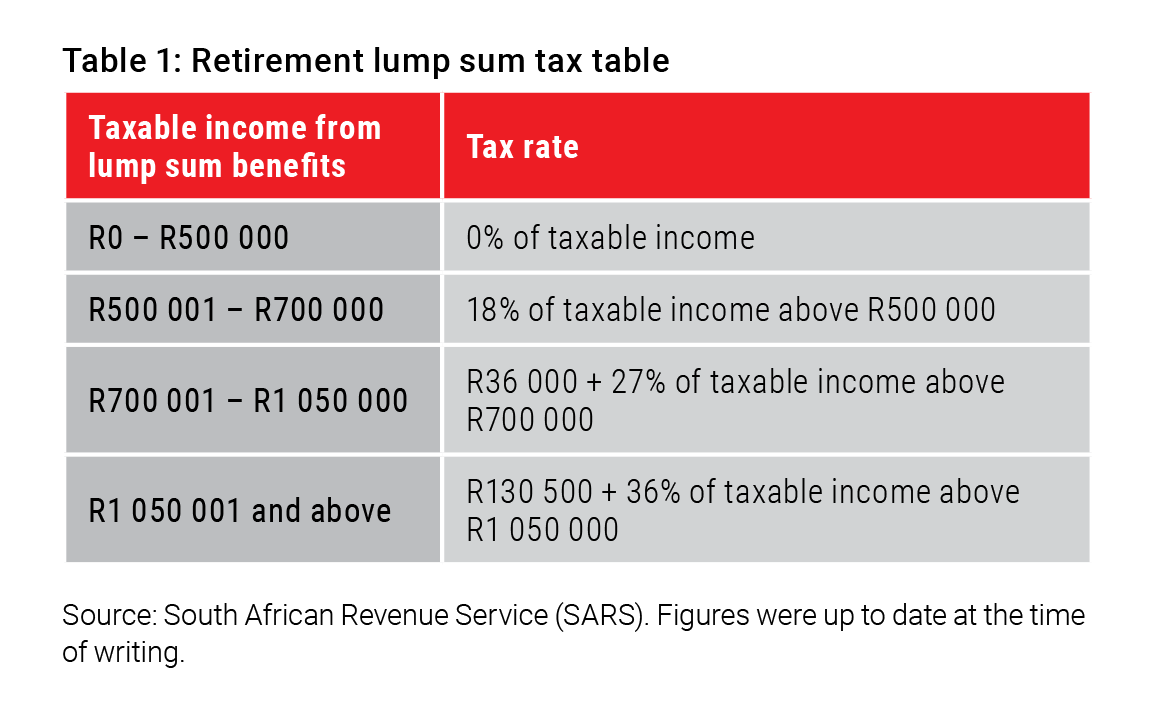

South African Tax Tables 2025 Myrle Ortensia, Find income tax, vat, transfer duty & other tax rates for the past 10 years.

Budget 2025 Your Tax Tables and Tax Calculator TGS South Africa, The latest tax data from sars shows that the taxman collected r2.2 trillion in gross tax revenue in the 2025/24 fiscal year, r87.0 billion or 4.2% more than in the prior year.

Sars Tax Tables 2025 South Africa Jilly Lurlene, If you are looking for an alternative tax year, please select one below.

Tax Brackets 2025 South Africa Goldy Karissa, In this section you will find a list of income tax.

Tax Brackets 2025 South Africa Sars Cordey Marcile, This tool is designed for simplicity and ease of use, focusing solely on income tax.

Federal Tax Deductions 2025 Leia Shauna, The south african revenue service (sars) provides tax tables annually to help individuals and businesses calculate their tax liabilities.